Increase efficiency and visibility

Automate virtually all routine accounts receivable tasks online and have all data automatically synced with your ERP.

Simplify the invoice-to-cash process by automating accounts receivable, streamlining payment acceptance, and collaborating with teammates and customers in one AR solution.

Versapay’s Collaborative AR solution combines industry-leading automated accounts receivable, intuitive collaboration tools, and a next-generation B2B payments network.

Automate virtually all routine accounts receivable tasks online and have all data automatically synced with your ERP.

Automate everything from invoicing to accounts receivable collections so your team can focus on strategic activities.

Collaborate with customers online to quickly answer questions and resolve disputes.

Traditional accounts receivable automation software isn't effective in today's world. Versapay's Collaborative AR solution lets you connect with customers to resolve issues before they hurt your cash flow. Learn why top teams choose Collaborative AR.

Add built-in, secure click-to-pay links directly to invoices and accept payments inside your portal.

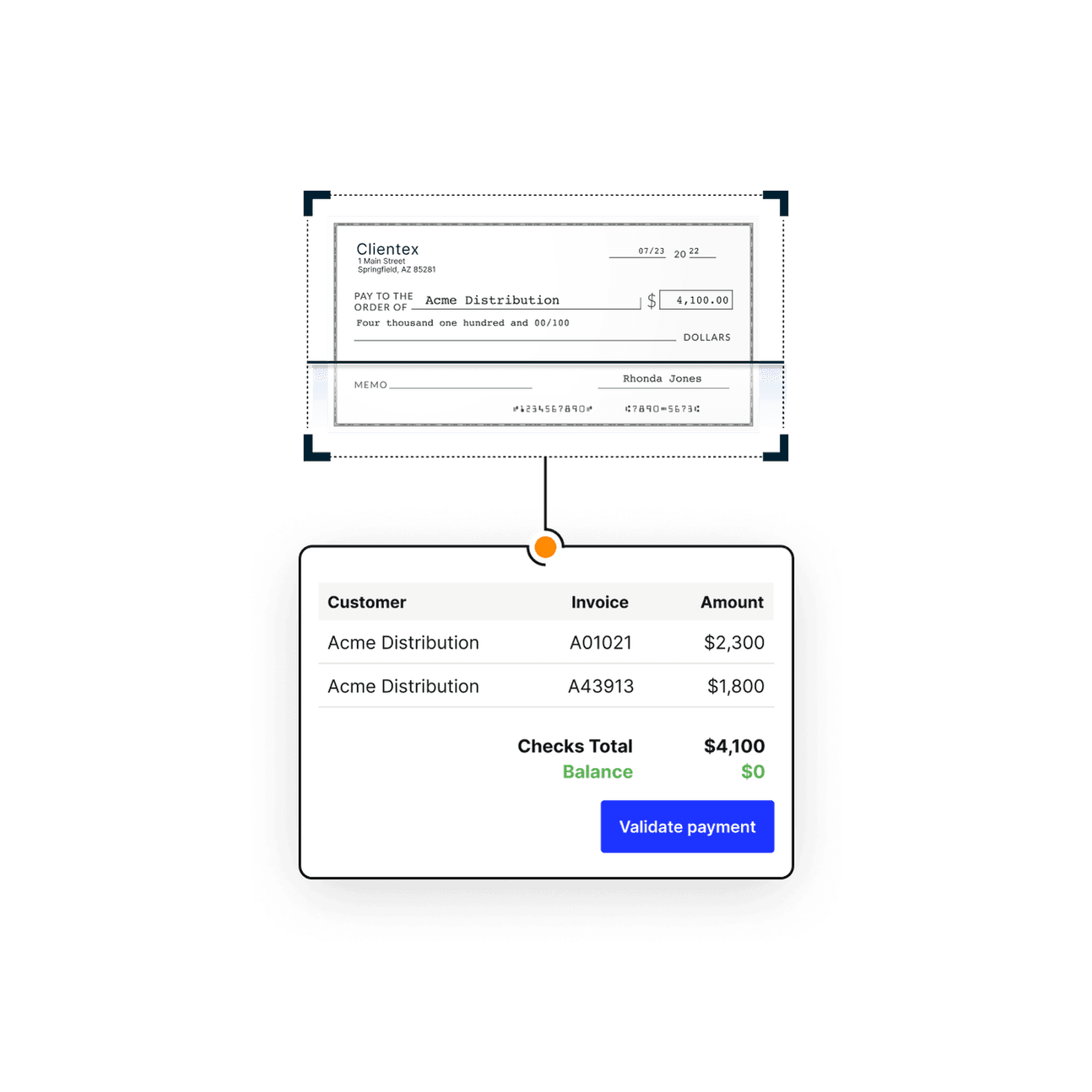

Accept multiple payment methods securely including credit cards, ACH, checks, and virtual cards.

Set fully customizable online payment acceptance rules, including automatic recurring payments with autopay.

Manage all accounts receivable activities in one place. Set up custom electronic invoice and statement delivery options with accounts receivable automation.

Get real-time visibility into e-invoice delivery status to see if customers received and opened email notifications using Versapay's supplier portal.

Let AR automation handle the day-to-day invoicing tasks so your team can focus on critical tasks.

Access real-time analytics that put all billing and accounts receivable collections information at your fingertips.

View entire account histories, and drill into customer data, including outstanding invoices, payments, credits, and interactions.

Automate collection tasks like upcoming and late payment reminders with configurable notifications so your staff can focus on more valuable work.

“With Versapay, we're starting to see our receivable balance get lower and lower, which means that there's more cash coming in the door, which is great.”

“Versapay gave us the ability to process credit card payments and ACH in real-time. Customers can apply and split payments however they'd like, and no one from our organization needs to touch the transaction.”

Choosing the right AR automation software can be easy. This guide, complete with 12 interactive checklists, will help you make the right choice.

In this guide, you’ll:

Automated accounts receivable involves automating the process of receiving and recording payments from customers for goods or services provided by a business. This can include pre-setting reminders for payments, electronic invoicing, online payment portals, and payment reconciliation. By automating these tasks, you can reduce manual work, improve efficiency, and provide more accurate and timely recording of transactions.

While accounts payable (AP) refers to liabilities a business owes, accounts receivable (AR) refers to the funds a business is owed by its customers. Essentially, AP is money out, and AR is money in. AR automation involves automating tasks such as sending invoices, collecting payments, and applying payments to open receivables. On the other hand, AP automation involves automating tasks such as paying invoices and recording those payments.

There are many reasons accounts receivable automation software is critical to modern businesses:

AR automation software streamlines cash flow in a few different ways:

Key Performance Indicators are critical to understanding how AR directly impacts business performance. The following are three of the most tracked in accounts receivable: