What Is a Dunning Letter? Tips for Collecting Past-Due Invoices Faster

- 12 min read

Learn how dunning letters can help you collect on past-due invoices faster and improve accounts receivable.

And be sure to check out the dunning examples we've included from real Versapay customers!

Dunning letters, also called dunning notices, are communications that a business sends to customers to prompt them to pay an overdue bill. These letters are crucial to the collections process, as they provide a systematic and widely recognized way to alert those who owe money that their account must be settled.

Lack of an effective dunning process can leave companies struggling to communicate the urgency and details of the situation to customers, leading to further delays in payments, misunderstandings, customer dissatisfaction, and constrained cash flow.

Let’s look at the ins-and-outs of delinquent accounts, the traditional methods of conducting the dunning process, examples of dunning letters, how to track the process, and ways of improving it through automation.

Table of contents

Understanding delinquent accounts

A delinquent account is one on which a customer owes money, reflecting a late payment or non-payment for purchases the customer has made. The degree of delinquency in customer accounts can range from mild, with just a small amount only slightly overdue, to severe, with large sums extremely late.

In most cases, those who fail to pay their invoices on time are not doing so with malicious intent. There are a host of reasons businesses may be delayed in making payments, from cash flow problems to postal delays. Here are six possible reasons why customers may be late sending in what they owe:

1) Administrative errors — Customers may be making mistakes in their administrative workflows that inadvertently introduce payment delays, such as an inefficient process of routing invoices to the appropriate staff members.

2) Financial problems — A common reason for late payment is customers lacking the funds to pay the amount owed, whether because they are waiting on late payments from others or have mismanaged their finances.

3) Poor communication — Customers may be confused as to what they owe when due to poor communication on the seller’s part, such as unclear invoices.

4) Postal delays — Companies that send invoices manually, via traditional channels like mail may occasionally face delays in their invoices getting to recipients.

5) Unacceptable payment options — Customers tend to have preferences about payment methods, and they may be slow to pay if you don’t offer the option their accounts payable function is set up to use most readily.

6) Evasion — There are certainly cases where customers simply don’t want to pay, and they may be actively evading your attempts to collect.

How the dunning process traditionally works

The dunning process traditionally follows a set progression, with communications shifting in content and tone as an account becomes increasingly overdue. The process typically includes three steps, although there are no set rules on the timing of when each letter should be sent and the rate at which the language should escalate in firmness.

The tried-and-true (albeit imperfect) dunning process looks something like this:

1. Initial reminders

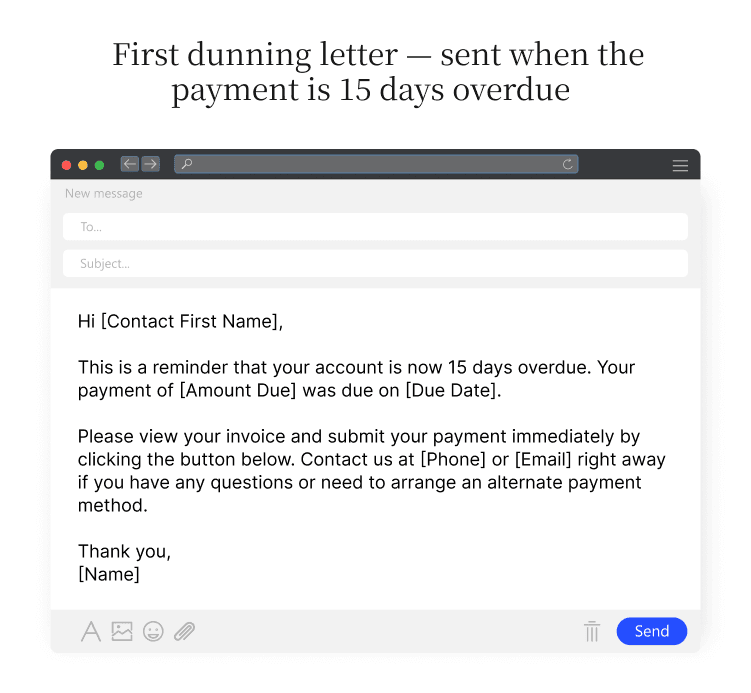

It’s common to send the first dunning letter, a simple reminder to pay, as soon as the account is overdue. Some companies wait until the account is 15 or 30 days overdue, while some send letters at 1, 15, and 30 days. These first letters include a polite and straightforward request for payment, a statement of the amount owed and how many days overdue the payment is, instructions on how to pay, contact information for questions, and, if applicable, a general description of what may occur with continued non-payment, such as an account being shut off.

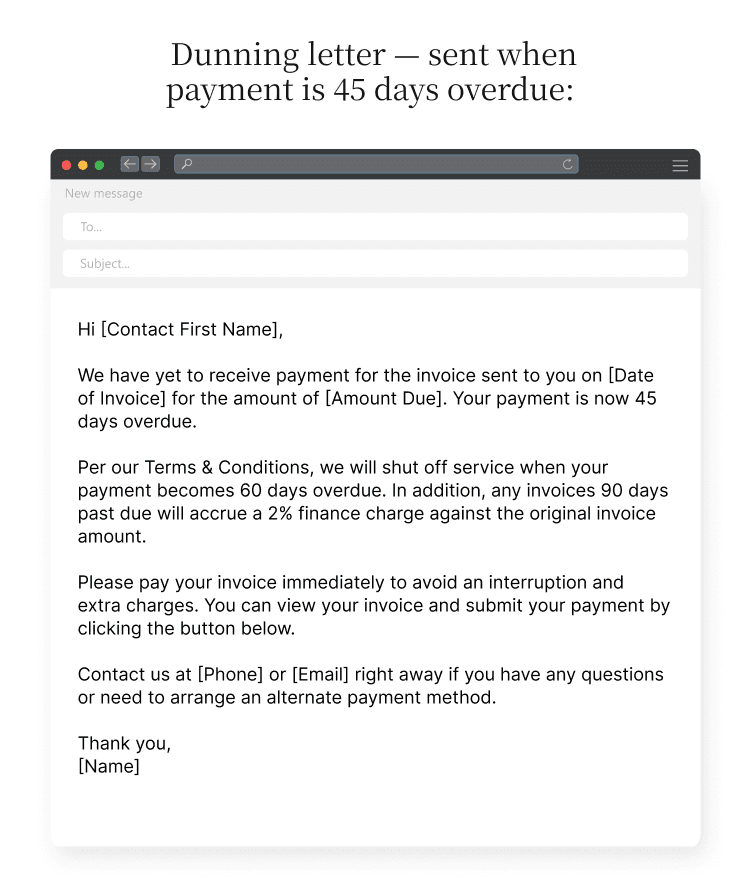

2. Subsequent dunning notices

After the initial set of polite notices, dunning letters often take on an increasingly formal tone and emphasize more prominently what will happen if the bill is not paid. Consequences are typically services being curtailed and late fees being added to the account. These notices may be sent out at 45, 60, 90, and/or 120 days after the payment due date, or at other times as a company sees fit.

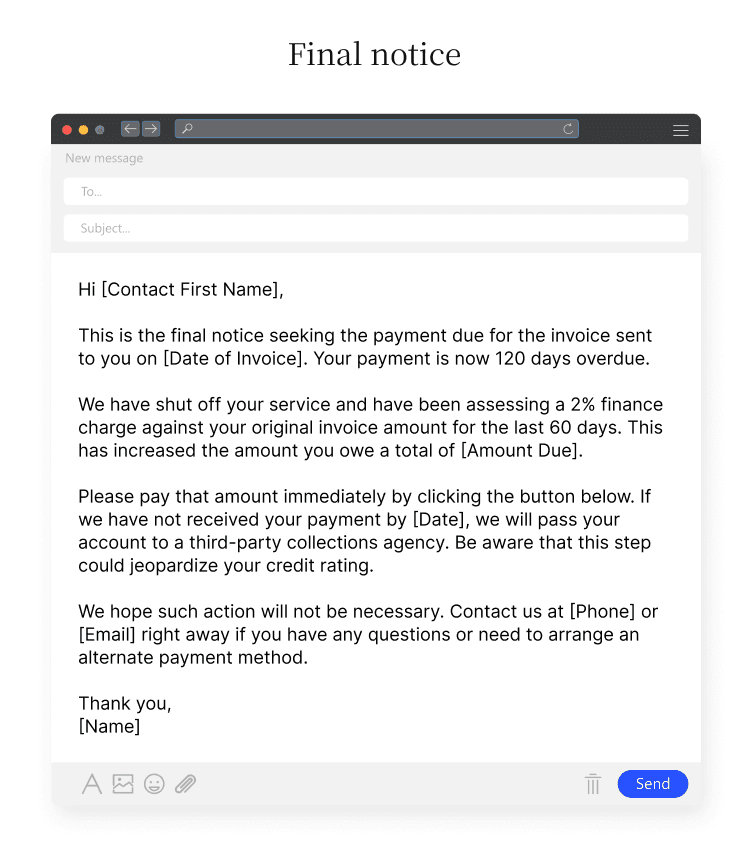

3. Final notice

At a certain time after the invoice was due and payment hasn’t been received, typically 120 days or more, a business will send out a final letter notifying the customer that unless payment is received by a certain date, the company will proceed with consequences, such as shutting off services, and will take some action in response to nonpayment.

That action could be sending the account to a third-party collections service or getting legal counsel involved. This letter should clearly state that it is the final notice, the amount owed (including any late fees that have been added), the date by which the customer must pay, the consequences of not paying, the way they can pay, and the contact number for questions.

Examples of dunning letters

There is no one way to write a dunning letter, but looking at examples can be helpful. However you decide to compose yours, make sure that the amount due, the due date, and the method(s) of payment are very clearly indicated so there can be no confusion. Also always include your contact information.

First dunning letter example, sent when the payment is 15 days overdue:

Dunning letter sent when payment is 45 days overdue:

Here’s an example of a final notice:

You can use those above examples today and start collecting more of what you're owed! And if you're looking for more dunning letter examples, here are three notices that real Versapay customers have sent. Please note that we’ve anonymized our customers’ brands for confidentiality reasons:

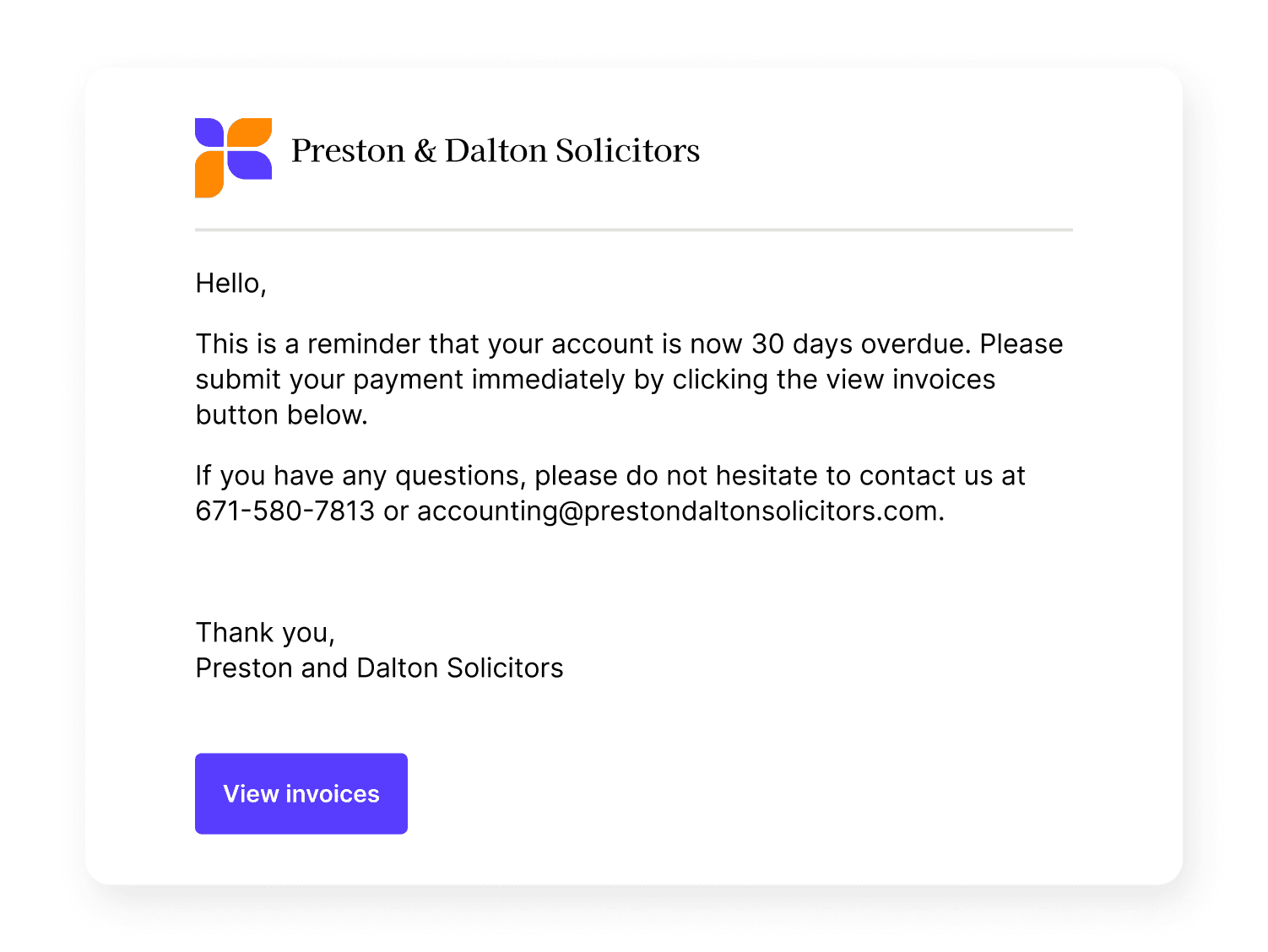

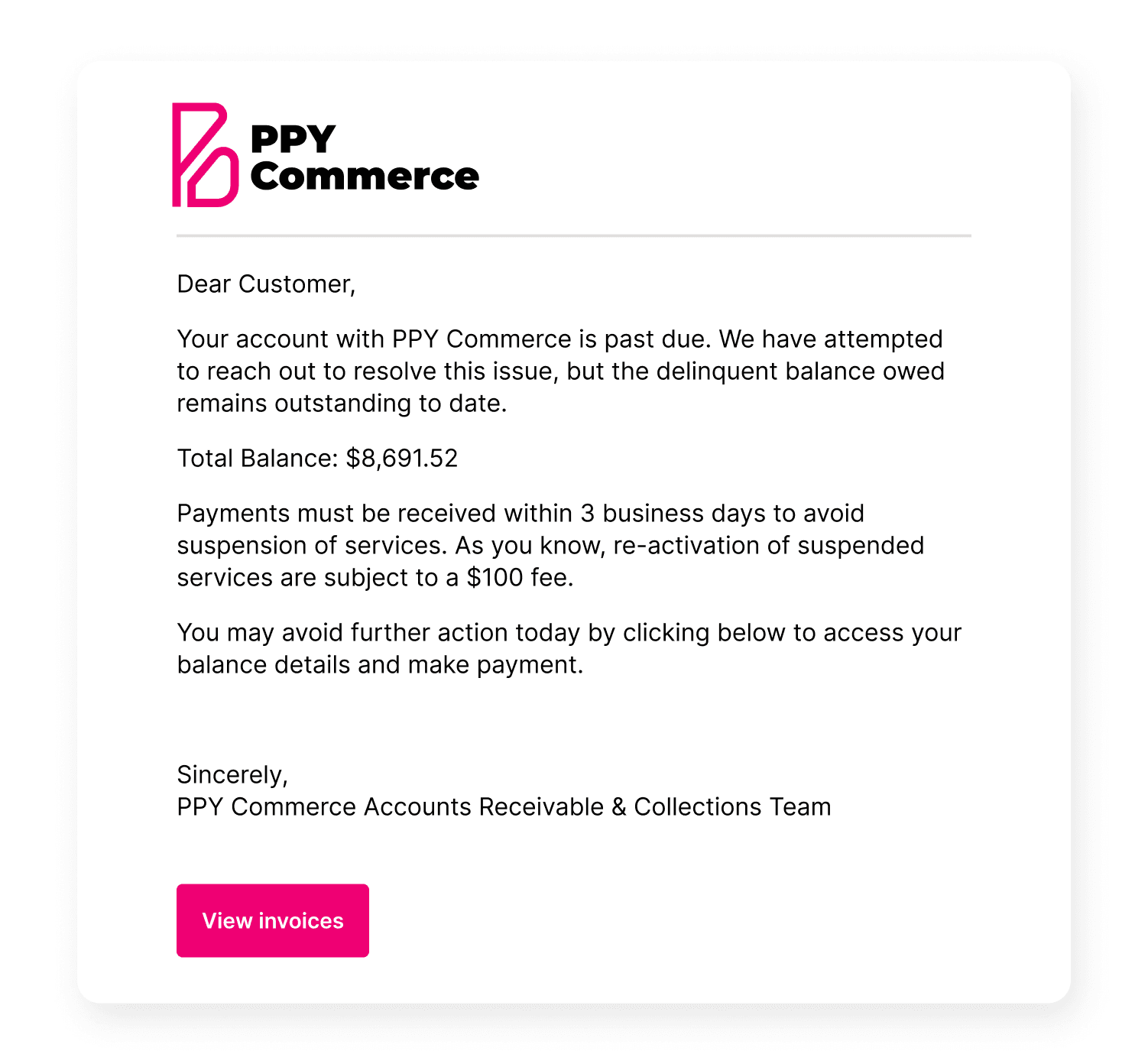

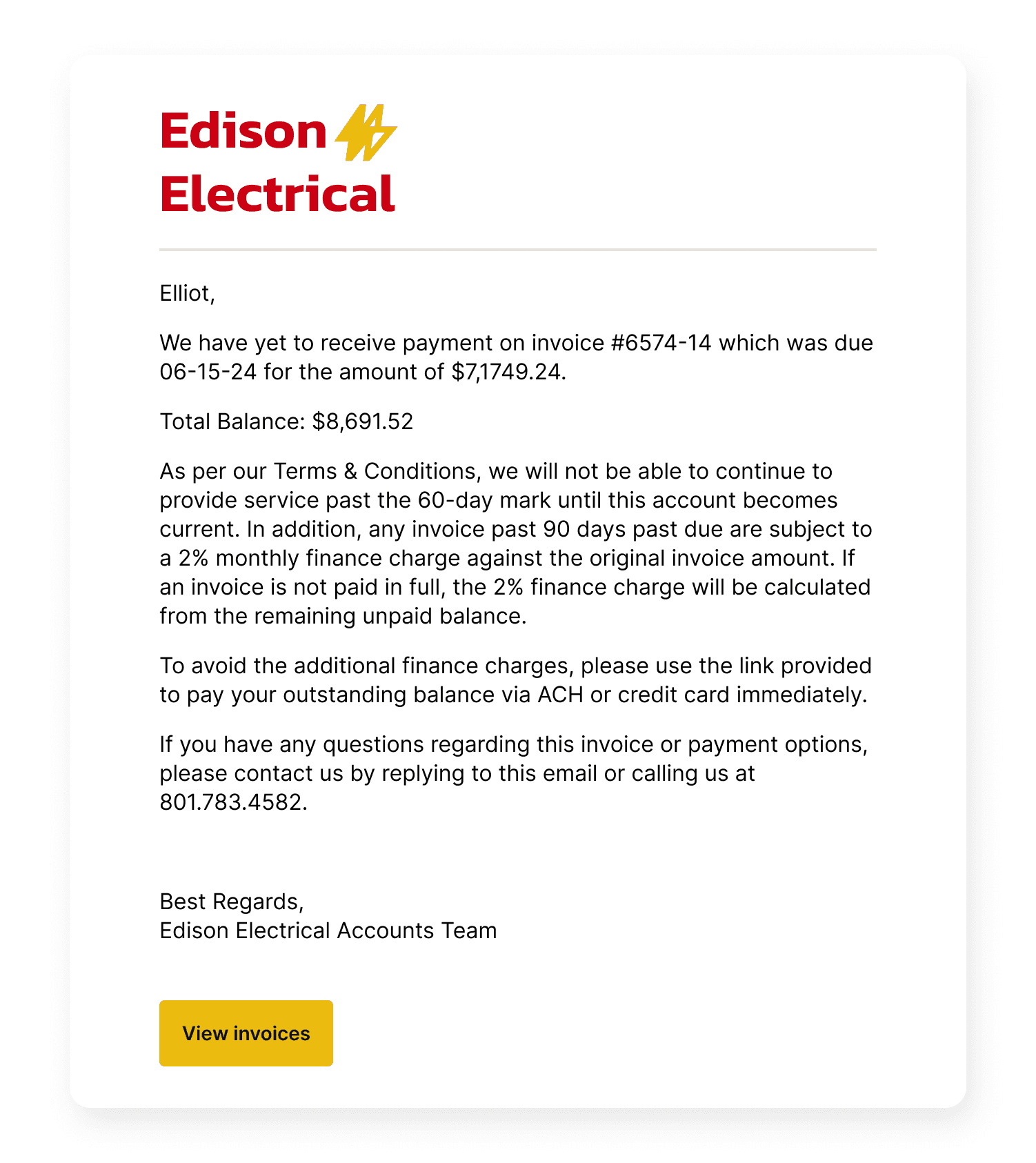

Here is an notice that a Versapay customer sent:

When a payment was 30 days overdue:

When a payment was between 30 and 50 days overdue:

When a payment was more than 50 days overdue:

Payment reminders vs. dunning letters

Not all reminders to pay a bill are dunning letters. Any prompts you send before the payment is actually overdue can simply be called payment reminders. Some companies might send such reminders at 15 or 30 days after the invoice is sent, even if the payment is not due until day 30.

Once a customer has failed to pay on time, the reminders that go their way are now called dunning letters. When to send both payment reminders and dunning letters is a judgment call, and can depend on considerations like the customer’s payment history, the company’s relationship with the customer, previous communications, and other things that matter to the seller.

How to send dunning letters

Traditionally, companies mailed dunning letters, and then turned to email once communications went digital. An emailed dunning letter might be sent as a PDF attachment, or the communication might make up the body of the email itself.

Now that accounts receivable automation software is more common, dunning letters can be conveyed to customers via a cloud-based payment portal. This is a convenient way to ensure that the customer has ready access to the letter, and can pay quickly and easily through the portal.

Portals are one of the “collaborative” methods you can use to work with your customers to arrange payments, instead of engaging in antagonistic, one-way communication. Collaborative payment processes help you improve your process, better satisfy your customers, and get payments more reliably and quickly.

How to track dunning letters and collections performance

Tracking the details of your dunning process and its effectiveness is the best way to see what is working and what needs to be changed in your collections efforts.

Keep tabs on metrics like response rates to dunning letters, payment recovery rates, days sales outstanding (DSO), customer satisfaction scores, and other indicators that show the functionality (or lack thereof) in your process. You can go deep with the data, such as looking at 11 accounts receivable KPIs that can give you a well-rounded picture of your AR health.

Other indications your dunning process needs help include:

High volumes of payments past-due

Growing numbers of delinquent accounts

Low dunning letter open or response rates

High customer attrition and/or complaints

High card declines stemming from outdating information, which trigger dunning outreach

Staff dissatisfaction or burnout

There are a range of popular tools and software that help track and automate the dunning process. Online invoicing software is one option. Full accounts receivable automation software is a more comprehensive choice, providing you not only abundant metrics and automations, but also a collaborative payment portal to help customers work with you.

How to improve the dunning process

Digitization and automation allow you to conduct your dunning process more efficiently and effectively than its traditional format. Accounts receivable automation software allows you to make the process more customer-friendly, such as by offering multiple payment methods and collaborating with customers in real-time through a cloud-based portal to settle accounts.

Other ways you can improve your accounts receivable process include:

Personalization of dunning notices to customers and segments

Proactive outreach strategies

Customer education on payment policies

Offering flexible payment methods and plans

Training staff on effective communication and negotiations

All of these elements of the process can benefit from automation. Overall, automating your AR process is a foundational way to transform your dunning process—and ultimately prevent accounts from reaching this point of delinquency. Learn more about automating your collections function in our CFOs Guide to Accelerating Collections.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.