Average Days Delinquent Explained: How To Calculate It and Why It’s Helpful to AR Teams

- 9 min read

Average days delinquent is a metric accounts receivable teams use to determine how late on average customers pay their invoices. It provides additional insight into the severity of late payments that DSO alone won't provide.

A business’ ability to effectively manage their accounts receivable (AR) depends on them actively tracking a range of metrics, from AR turnover ratio to collection effectiveness index.

One of the key metrics your AR team will want to keep track of is average days delinquent (ADD), sometimes called delinquent days sales outstanding. This metric looks at how many days late customers’ payments are, on average, at any given time.

Using average days delinquent as a key performance indicator (KPI) for AR can provide you with a strong understanding of how well your customers are complying with your desired payment terms. Knowing your ADD can open the door for greater analysis of your collection efforts and where you have room to improve.

In this article, we’ll discuss:

- What average days delinquent is

- The difference between average days delinquent and days sales outstanding

- The value in measuring average days delinquent

- How to calculate average days delinquent (with examples)

- Tips for speeding up collections and improving average days delinquent

What is average days delinquent?

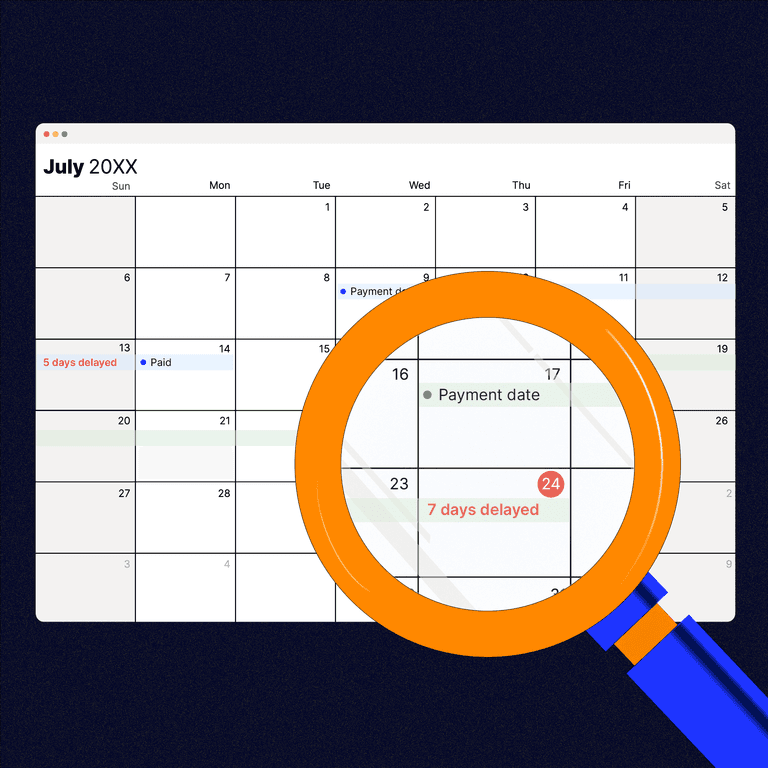

Average days delinquent tells AR teams how late customers’ payments are on average, at a particular moment in time. ADD looks only at late payments, not all outstanding customer payments. This metric offers a sense of whether your average late payer is delinquent by just a little or by a lot.

Higher ADD rates reveal that your customers tend to be slow to pay, while lower ADD rates reveal that your customers are generally faster to remit.

It’s best to assess your ADD output in the context of your company’s industry and how competitors are performing. Average days delinquent as a measurement is also most meaningful when looked at as a trend over time and in comparison to other metrics, such as days sales outstanding (DSO).

What’s the difference between average days delinquent and days sales outstanding?

On the surface, average days delinquent sounds a lot like another metric AR professionals commonly use: days sales outstanding. Both are concerned with the time it takes for customers to pay their invoices.

But, there’s one important distinction. DSO measures how long customers take on average to pay their bills, including payments that are early, on time, and late. By contrast, ADD only looks at payments that are late.

Average DSO provides you with an understanding of how good your average customer is at paying on time since it looks at payment times for your customer base overall. ADD, on the other hand, provides you with an understanding of the severity of late payments overall.

What's the value of measuring average days delinquent?

Because DSO looks at customers’ payment times in aggregate, if you have some customers paying you exceptionally early and some paying you exceptionally late, it’s possible for these two subsets to cancel each other out. This could potentially hide the problem of late payments from view, which is why looking at late payments in isolation with ADD provides a helpful perspective.

Collections staff will usually look at ADD in combination with DSO to form insights. DSO and ADD typically trend in the same direction, indicating an overall improvement or decline in the effectiveness of collections. When DSO and ADD rise or fall together, any new developments in your collections process are likely the reason for this.

If they move in different directions, however, it’s typically a reflection of another factor at play such as a recent change in your payment terms (e.g. a tightening of credit policies or a shortening of the collections cycle).

If your DSO and ADD are high compared to what you expect or desire, it might indicate problems with your internal operations or customer base. Internal issues may include understaffing, disorderely collections processes, or ineffective communication with customers.

How do you calculate average days delinquent?

Average days delinquent formula

There is a simple formula for doing an average days delinquent calculation, which starts with calculating your DSO and best possible days sales outstanding (BPDSO). Best possible DSO indicates the most ideal timeline in which you could expect to collect payments. It represents how fast you could get paid in a perfect world and gives your collections department an ideal to aspire to (though it’s rare that your actual DSO will match it).

Here are the formulas to calculate those metrics:

- DSO = (Accounts Receivable ÷ Total Net Credit Sales) x Number of Days in Period

- BPDSO = (Current Accounts Receivable ÷ Total Net Credit Sales) x Number of Days in Period

Once you’ve determined those values, they’ll plug into the following formula to calculate average days delinquent:

- ADD = DSO – BPDSO

Average days delinquent example

For an average days delinquent example, let’s imagine a fictitious company called Walker’s Widgets. The company makes $120,000 in total net credit sales during a period of 90 days between January and March. During those same 90 days, Walker’s Widgets has receivables totaling $80,000. The company’s DSO is 60 days ([$80,000 ÷ $120,000] × 90 days = 60).

The value of Walker’s Widgets’ receivables that are current—meaning they are not yet past-due—totals $32,000. This would mean the company has a best possible days sales outstanding of 24 days ([$32,000 ÷ $120,000] × 90 days = 24).

The AR team at Walker’s Widgets uses their DSO and BPDSO for the period to determine their ADD, which they find to be 36 days (60 – 24 = 36). This means that on average, their customers’ late payments are 36 days past due.

—

Average days delinquent is just the start. Learn the AR metrics you should be measuring, how to measure them, and what you can do to make them soar in this on-demand webinar.

5 tips for speeding up collections and improving ADD

1. Clearly communicate payment deadlines on all your invoices

One reason for high delinquent days sales outstanding is ineffective communication of payment terms to customers. Your buyers may not see the due date clearly on the invoice. Or maybe you neglected to include it altogether, or the terminology isn’t clear. It’s important to use standard terms that make sense to the customer when communicating payment expectations, such as “net 30” or “end of month”.

2. Make it easy for customers to know what they owe

Clearly indicate on the invoice the amount the customer should pay. To make it even easier for customers to track their bills, consider providing them with an online payment portal where they can review all their open invoices and make payments.

A great way to incentivize customers to pay this way is to provide a link to your online portal on all your invoices and even in your email signature.

3. Automate your collections and dunning notices

Automating your collections and dunning notices can help ensure you’re proactively notifying customers of upcoming payment due dates before they pass. Sending these notices manually takes time (especially when you have a large customer base). That means your team might not get around to notifying a customer of their overdue invoices until well past the due date.

When it comes to collections, time is of the essence, as your chances of collecting on an invoice diminish the more time passes. Automating collections notifications removes the burden from your team and helps you get paid sooner as a result.

4. Routinely evaluate customers’ creditworthiness

If your average days delinquent is higher than you’d like, it may be due to a problem with your customer base, such as too high a proportion of buyers with poor credit.

If your data shows that your customer base is, on average, inclined to delay or shirk payments, then it’s a good idea to assess which customers you should and shouldn’t be extending credit to. For your customers that might be slower to pay, can you work with them on a payment plan that will work for both of you?

5. Solve payment disputes faster with collaborative AR automation

Customers are sometimes late to pay because they have a dispute they’d like to settle with your company before they will release the funds. A collaborative accounts receivable solution enables customers to communicate with you about invoice issues in a more natural way—and in a central location. This allows your team to more easily track and address invoice disputes. No more sifting through multiple email threads and siloing information to a single person’s inbox.

This collaborative approach to dispute resolution prevents payments from being held hostage, resulting in lower average days delinquent.

Becoming a data-driven AR team

Measuring average days delinquent should be a key part of any data-driven AR team’s self-evaluation process, along with other metrics like DSO and customer satisfaction. Together these metrics can tell you a lot about how effective your internal processes are and whether your customer base is responding well to your collections efforts.

Regularly tracking metrics like ADD will give your team an early warning if something is amiss, allowing you time to troubleshoot effectively.

Need support with mapping out your core KPIs for measuring accounts receivable performance? Check out our AR Performance Toolkit.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.