What is Collaborative Accounts Receivable? The Better Approach to AR

- 14 min read

In this blog, we’ll explain why the traditional B2B payment experience leaves much to be desired for buyers and suppliers alike, why automation in AR is necessary (but not the final step), and how a collaborative AR solution is key to maximizing account receivable’s potential.

We’ll also define what collaborative accounts receivable is and break down the differences between it and more traditional autonomous receivables solutions.

Collaborative accounts receivable (AR) is a new and better approach to managing receivables. It goes beyond traditional autonomous receivables to focus on improving how business-to-business (B2B) buyers and sellers collaborate during the billing and payment process to make the experience quick and painless.

By giving accounts receivable teams the collaboration tools needed to directly communicate and work with their customers’ AP teams, collaborative AR boosts efficiency, accelerates cash flow, and delivers exceptional customer experiences.

In this blog, we’ll explain why the traditional B2B payment experience leaves much to be desired for buyers and suppliers alike, why automation in AR is necessary (but not the final step), and how a collaborative AR solution is key to maximizing account receivable’s potential.

Jump to a section of interest:

Why accounts receivable needs to automate (then go further)

To reach peak performance, you need to digitize every department in your organization.

That’s an assertion that most executives can get behind. In fact, research shows they do, with 92% of C-level leaders agreeing with this statement according to a survey of 1,000 executives we ran with Wakefield Research.

Back-office processes like accounts receivable are traditionally mired in manual work and don’t get much attention when it comes to technology investment. The same study we referenced above found 60% of C-level executives agree that their AR department hasn’t been prioritized as much as others for digitization.

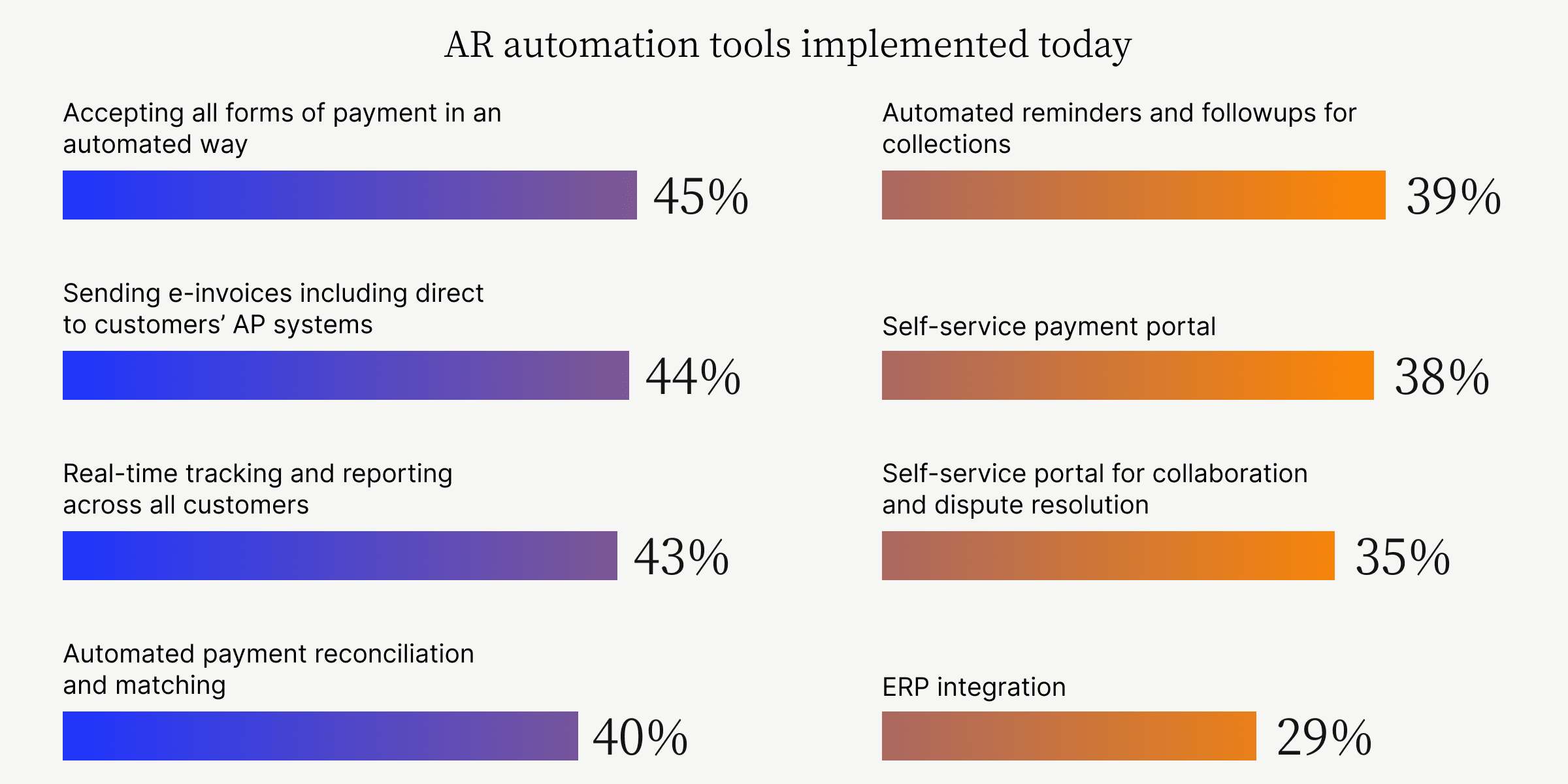

This critical business area finally seems to be getting its day in the sun, with nearly half (45%) of respondents stating they’ve implemented at least some form of accounts receivable automation. It’s worth noting, however, that most digitization efforts in AR departments have focused primarily on automating behind-the-scenes processes like payment acceptance and invoice delivery.

But automation alone isn’t a silver bullet for AR teams looking to reduce late payments and speed up cash flow. AR automation solutions overlook the fact that accounts receivable is an extension of customer service. There are few departments in a company that engage with customers as consistently as your AR staff does during the billing and payment process.

Most traditional AR automation tools—interchangeably called autonomous receivables tools—tend to focus on automating work within the AR department like invoice delivery, reporting, and payment matching. While these features are important, they fail to address the full scope of what slows down cash flow, namely invoice disputes.

Invoice disputes are often a result of misunderstandings and miscommunication between AR teams and their customers’ AP teams—an AR Disconnect, if you will—which traditional autonomous receivables solutions can’t help with. And there’s the conundrum:

Making your AR department more effective isn’t about using technology to take people out of the process; it’s about using technology to improve the way those people interact.

What is the AR Disconnect?

Here’s a scenario you might relate to:

Step 1 — Let’s say you’re a manufacturer and you have a customer waiting on a shipment of 200 parts. You deliver the shipment and the invoice, but when the customer receives their order, they find that a portion of the parts are damaged.

Step 2 — Your customer contacts your sales team to inform them of the issue and attaches a photo documenting the damage. Sales then provides verbal confirmation that the damaged goods will be subtracted from the amount they owe. That sales rep then forgets—for any number of reasons—to inform AR about the agreed deduction.

Step 3 — With no record of the approved short payment, your accounts receivable team later sees the payment come in for less than owed and then calls the customer to inquire about the missing amount. Understandably, the customer isn’t very happy.

This is just one of many common problems with accounts receivable your team faces daily. In situations like these, customers might even question whether they want to continue doing business with you. So much of the frustration experienced in the invoice-to-cash process is a result of miscommunication.

‼️ This is the AR Disconnect ‼️

It’s the chasm that forms between you and your customers during the payment process due to a lack of transparency into receivables, ineffective communication methods, and a reliance on manual workflows.

The AR Disconnect manifests itself as:

An invoice that gets lost or received by the wrong person

Collections notices that get buried in your customer's inbox

A check that’s “in the mail”

Unexplained short payments

Payments with missing or incomplete remittance information

Invoices with insufficient supporting documentation

All this creates more work for your AR team and makes for a negative experience for your customers.

—

You've learned the basics of Collaborative AR. Now, see it in action as we detail how it accomplishes what automation alone can't in this on-demand webinar.

How does the AR Disconnect harm your business?

Beyond making your accounts receivable team’s and your customers’ accounts payable (AP) team’s lives harder, the AR Disconnect has real implications for your cash flow. This includes:

Delayed or delinquent payments

Lost customers

Lost productivity

Legal disputes

1. Delayed or delinquent payments

When customers take issue with an item on their invoice, they’ll intentionally hold off on paying it until it gets resolved. In fact, 30% of suppliers say instances of their customers’ defaulting on payments is largely due to disputes.

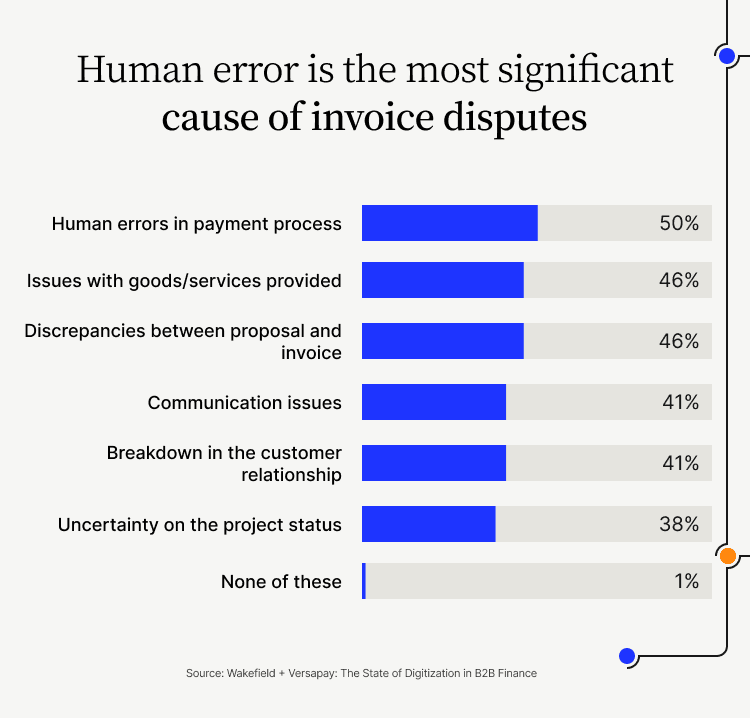

The main causes of invoice disputes are mostly things associated with the AR Disconnect: human error, miscommunication, and individuals left out of the loop.

In our survey with Wakefield Research, human error was reported to cause invoice disputes more often than issues with actual goods and services provided. Discrepancies between proposals and invoices, general communication issues, and breakdowns in customer relationships were also high on the list of dispute causes.

Ineffective communication between your AR team and your customers—so often part and parcel of traditional AR processes—directly translates to late payments and, in the worst cases, bad debt.

2. Lost customers

Misunderstandings and miscommunications during the payment process can also hurt your ability to retain customers.

In our survey with Wakefield, 82% of respondents said they had lost business due to conflict or confusion during the invoice to cash process. Over half of them (42%) said this happened to them multiple times.

The billing and payment experience is not typically regarded as a sticking point for customer loyalty. But research clearly shows that it is. A joint study by PYMNTS and Worldpay also found that 85% of B2B buyers value a positive experience with a potential vendor as much as the products or services they offer. That extends to the experience buyers have of working with your AR team.

A negative payment experience caused by the AR Disconnect could mean losing an otherwise happy customer.

3. Lost productivity

When your AR team is unable to recover a payment due to an ongoing dispute, then comes time to bring in the big guns. Nearly all businesses we surveyed (98%) say that upper management has had to get involved in payment issues or dispute resolution at some point. Even worse, 44% say this happens often or all the time.

Seventy-eight percent of respondents also said the payment conflicts they face could have been avoided through better communication at least some of the time.

Dealing with invoice disputes caused by the AR disconnect results in lost productivity from not only your AR staff, but your executives too, making it everyone’s problem.

4. Legal disputes

When neither your accounts receivable specialists, nor your upper management can resolve a dispute, it might escalate to legal action. In these cases, not only might you not be able to recover the invoice amount, but you might also be looking at hefty legal fees if you choose to pursue the matter in court.

This happens more often than you might think, with 64% of C-suite executives reporting that an invoice dispute has resulted in the threat or initiation of a lawsuit.

By prioritizing more effective communication from the start of the invoice to cash cycle, you avoid souring customer relationships and costly legal nightmares.

—

C-suite leaders seem to be aware of their business’ shortcomings when it comes to handling the “human” side of accounts receivable. Seventy-three percent of executives report that their invoice to cash cycle is a frequent source of negative customer experiences.

So, if the overwhelming majority of executives are aware that they have a customer experience problem in accounts receivable, then why haven’t they solved it yet?

Well, for starters, we know the accounts receivable department has been prioritized less across the business for improvements or technology investments in general compared to other departments, a sentiment strongly felt among CFOs (69%).

But, more crucially, the solutions that finance departments have had for addressing their limitations in invoice to cash—traditional, autonomous receivables software—just don’t account for the human side of accounts receivable.

That’s why Versapay created Collaborative Accounts Receivable.

What is collaborative accounts receivable?

Collaborative accounts receivable uniquely addresses the most common challenges in accounts receivable (like resolving payment disputes and maintaining good relationships with late-paying customers) stemming from the widening communication gap between AR teams and their customers’ accounts payable teams.

Instead of just treating the symptoms of these issues, collaborative AR focuses on the root cause, which means it directly tackles the sources of miscommunication and stakeholder misalignment.

Versapay has created the world’s first Collaborative AR Network, which is what you get when you combine industry-leading accounts receivable automation with powerful cloud-based collaboration tools, and then add on a next-generation B2B payment network.

And what do we mean by “network”? Well, once you gain access to the network, you can easily transact with others already on it. If a buyer makes purchases from multiple suppliers that use Versapay, they only have to set up their payment information once. They can then easily toggle between all their suppliers and make their payments from the same convenient system.

How does collaborative accounts receivable work?

💡 TLDR: Collaborative accounts receivable automation solutions are designed to solve the AR Disconnect. They give both your AR team and your customers’ AP teams critical visibility into the status of open receivables and a seamless way to communicate with each other to prevent and resolve invoice disputes quickly.

—

You—the supplier—can automate critical tasks like invoice delivery, collections reminders, and cash application as most people expect from an AR automation tool.

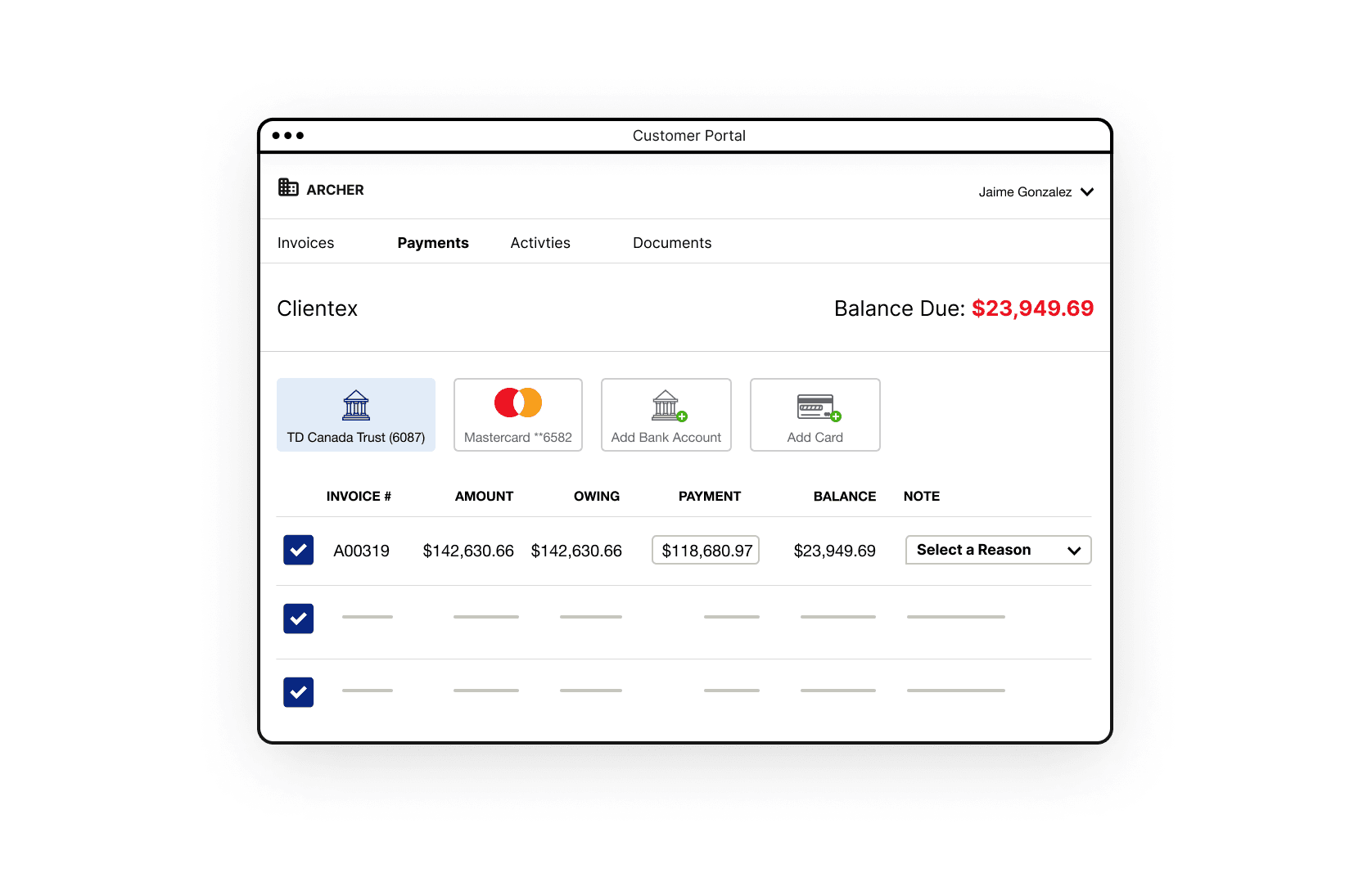

But, unlike most autonomous receivables platforms, collaborative AR systems give your customers a place to view their account status, all their invoices and related documents, leave comments or ask questions directly on invoices, upload relevant documentation, and make payments—all in real-time.

Then, members of your AR team—and even members of other teams like sales or customer success that need to be involved—can answer customers’ questions where everyone can see them. You no longer have to rely on email threads or notes from phone calls—which are difficult to make visible to your entire AR team in a scalable way—to get context on a billing issue

Essentially, collaborative accounts receivable solutions let you service your customers faster and—crucially—get payments in the door sooner. These technologies embrace collaboration and communication as a means for bettering the AR process.

What does collaborative accounts receivable look like in action?

Think back to that scenario we detailed earlier. With a collaborative AR solution, here’s what might have happened instead:

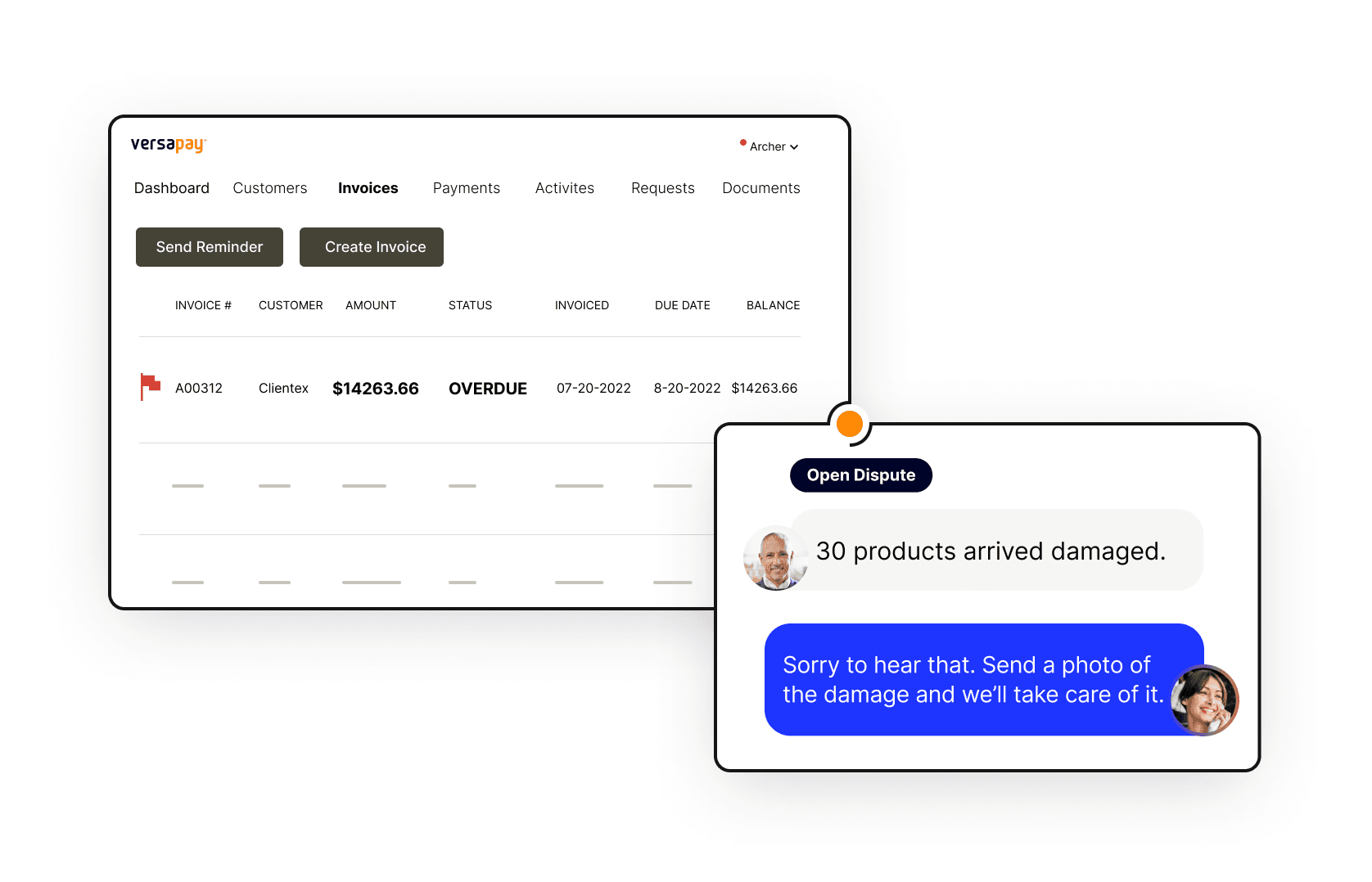

When your customer notices that a portion of auto parts they ordered are damaged, they open a dispute directly on their invoice. Your accounts receivable team sees their comment immediately, without Sales having to act as an intermediary.

When it’s time to make their payment, the customer makes a short payment directly through the platform’s online payment portal and clearly communicates the reason. Because the customer spells out why they made the short payment—and your AR team is already aware of the damaged goods—your collections specialist knows that missing money is accounted for and does not need to trigger any collections outreach.

Because the payment was made within your online accounts receivable payment portal—where the related invoice number is clearly stated—which integrates with your enterprise resource planning (ERP) system the payment gets applied immediately.

In this revised scenario, a collaborative accounts receivable automation solution made the experience of resolving the payment issue quick, seamless, and much less frustrating for everyone involved.

Collaborative AR vs autonomous receivables

An autonomous receivables solution focuses on automating back-end functions—like billing and invoicing, collections, deductions, and cash application— yet fails to view accounts receivable as a customer-facing, CX-driving function.

Autonomous receivables technology is mainly focused on automating the invoice to cash process through automation. It focuses on automating existing processes—which are typically broken to begin with—ensuring a ceiling on the efficiencies a business gains. In short, autonomous receivables software neglects the customer; it neglects the human side of accounts receivable.

And in a profession where communication and collaboration is so important and can turn the tides by accelerating cash flow, that human element is sorely needed.

Collaborative accounts receivable solutions on the other hand, fix the significant issues that AR automation alone won’t fix. In fact, only relying on automation to resolve AR challenges could make things worse. To transform accounts receivable, the customer experience needs to be drastically improved, and the collaboration-first focus that collaborative AR systems possess makes for a much better AR process.

In short, instead of simply automating back-office accounts receivable tasks, a collaborative AR solution also connects buyers—your customers—and sellers—you—over the cloud to speed up payments, eliminate inefficiencies, and deliver superior customer experiences.

Boost your bottom line with a customer-focused approach to AR

Most finance leaders’ game plan for improving their accounts receivable functions (if they have one) involves automating their team’s work—but forgets about customers. And that misses a big opportunity.

“Accounts receivable has traditionally been an out-of-sight, out-of-mind thing that people correlate with a negative experience. But it doesn’t have to be that way,” says Versapay’s Chief Financial Officer Russell Lester.

“You can take a part of the customer journey that people like the least and create light in that moment with just a little effort, by connecting AR teams directly with their customers’ accounts payable (AP) teams over the cloud.”

Beyond creating moments of delight in the last mile of your customers’ experience, embracing a more customer-focused approach to accounts receivable management also brings substantial improvements to your bottom line. For instance, after using Versapay our clients enjoy on average:

50% less manual work

30% fewer past-due invoices

25% faster payments

Versapay’s user-friendly customer payment portal entices your customers to keep using the platform, so you see a faster ROI. On average, our clients see customer adoption rates of over 80% for their customer payment portals, dramatically surpassing the average among traditional autonomous receivables vendors of 20%.

—

Wondering how collaborative accounts receivable might help your team? Take our six-minute assessment and receive personalized suggestions based on where you are in your digital transformation journey.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.