How Würth Canada Reduced Time Spent on Accounts Receivable by 75% Thanks to Mobile Check Processing

- 6 min read

Learn how Würth Canada unlocked up to $15,000 (CAD) in monthly operational savings and cut time spent on payment reconciliation by 75%, using Versapay's advanced cash application automation software.

—

Würth Canada, part of the Würth Group of global companies, has established itself in the Automotive, Trucking, Manufacturing and Construction Industries since its founding in Montreal, Québec in 1971.

The company’s core products consist of everything from DIN fasteners to electrical connectors, tools and PPE, as well as a complete line of chemicals. The company’s values are centered around quality, service, and reliable solutions for their customers.

With sales representatives covering all of Canada and an aggressive sales growth objective to achieve $270 Million (CAD) in sales by 2025, Würth Canada needed a more efficient and cost-effective way to collect check payments in the field and reconcile payments to customers’ accounts.

The challenge

Würth Canada is a well-established professional business partner to a vast range of commercial clients, from rural operations to multi-national conglomerates. Customers range in size from small auto repair shops with simple payments to large customers with detailed remittance advice for each payment—some as long as 20 pages.

Checks remain a primary method of payment for the company. Canada’s vast geographic footprint meant it was expensive for sales representatives to receive checks and forward them via courier to the head office in Guelph, Ontario to be applied to customer accounts.

“We have 40,000 customers across Canada serviced by over 470 sales reps. We accept a variety of payment methods, including credit cards and electronic funds transfers, but payment by check remains the preferred method of payment for most customers for now,” said Michael Malone, Credit Manager and Company Compliance Officer for Würth Canada.

“The majority of these customers mail their checks to our Head Office in Guelph via Canada Post, but many customers prefer to hand payments in person to their Würth Sales Representative. It’s not unusual to collect 50 checks per day in the field. Depending on the rep’s distance from our head office, it could cost anywhere from $10 (CAD) to $50 (CAD) to send checks via Purolator or other courier services.”

In addition to the high cost, Würth Canada’s sales reps also spent considerable time driving to the courier and completing the paperwork to send payments to the company’s head office—time which they could have spent meeting with customers or prospecting.

The solution

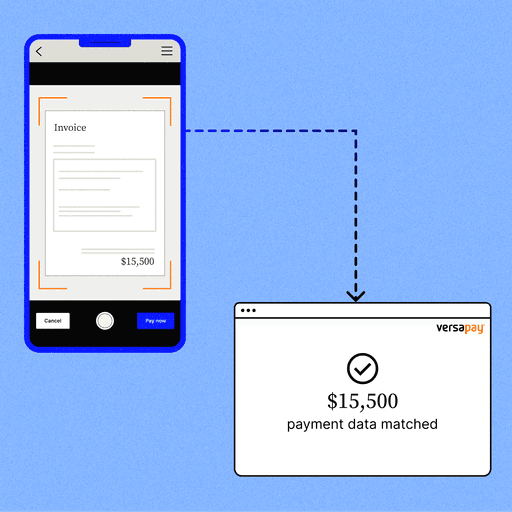

In 2017, Würth Canada implemented Versapay’s mobile check deposit and advanced cash application solutions (previously known as DadePay) with the primary objective of eliminating inbound courier costs for customer payments. They also wanted to allow their sales reps to spend more face time with their customers.

“Before Versapay, we were collecting checks, stamping them “For Deposit Only” by hand, and manually reconciling them to clients’ open invoices,” said Michael. “We did try using bank lockbox services, but that ended up taking up more time than it saved because, while we could get the money into the bank more easily, reconciliation proved to be more difficult. The number of exceptions generated more work to reconcile than the entire job would take in the first place.”

Collecting their approximately 1,000 checks per month through Versapay has saved Würth Canada between $10,000 and $15,000 (CAD) per month in inbound courier fees alone, with the average mailer costing around $13 (CAD) to ship.

“We decided to implement Versapay simply to eliminate the time and costs associated with collecting checks in the field,” said Michael. “But once we got up and running, we realized there were so many other benefits to the solution, including highly accurate automated reconciliation, comprehensive reporting, intuitive querying, and increased AR staff productivity. Versapay made so much more of an impact than I expected.”

The company also saves time and improves service by eliminating siloes created by disparate systems.

“For customer discrepancies or audits, we’re able to instantly recall every payment online going back as far as we need,” said Michael. “Data is no longer siloed from the bank to our enterprise resource planning (ERP) system. Now, everything is consolidated in one system that’s more easily accessible by a wider variety of staff so we can more efficiently resolve customer inquiries—and ultimately provide a better customer experience.”

The results

While the field sales representatives understood and appreciated the company’s goal of overall cost savings, once they realized how much selling time they’d get back thanks to Versapay, they quickly became excited.

“Of course, I was most excited about the cost-savings, but the field sales reps were quickly impressed by the time savings. They’ve gained back hundreds of hours of additional selling or personal time per month,” said Michael. “Now, it takes just 30 to 60 seconds to deposit a check. For reps serving rural areas, finding a courier drop-off location used to mean as much as a 30-minute drive. After launching Versapay in the field, the results were immediate and impressive.”

In the back office, Versapay has enabled Würth Canada to reduce time spent on accounts receivable (AR) by 75% and realize enough savings from not having to hire more full-time staff for the solution to pay for itself.

“We’ve been able to reduce 16 hours of daily work to about 4 hours,” said Michael. “Prior to Versapay, we had some staff whose only job was to apply payments to customer accounts. Those employees now have a broader and more satisfying range of responsibilities, including inbound customer information requests and following up on credit inquiries and applications. It has allowed us to maintain the same staffing level while managing exponential growth.”

Würth Canada’s collectors have also been able to eliminate some administrative tasks and streamline their focus thanks to cash application automation. “It’s given us a better balance across the entire department because it has eliminated so many administrative tasks,” said Michael. “We still have the same number of full-time employees in the department as we did six years ago, but we’ve saved 1.5 salaries by not requiring additional staff. That alone covers the cost of Versapay. Within the first month of using the solution, we’d already achieved a return on our investment in setup and implementation costs.”

Würth Canada views Versapay as an integral partner in streamlining its operations and positioning it for growth. “I wish every vendor was able to provide the level of competency and customer care I receive from Versapay,” said Michael.

—

Learn more about how we help finance teams automate payment matching and reconciliation with AI-powered advanced cash application.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.