Accounts receivable automation software streamlines the entire invoice-to-cash process—automating tasks like invoice delivery, collections follow-up, cash application, and reconciliation. By eliminating manual processes and improving visibility into receivables, AR automation software helps finance teams get paid faster, reduce DSO, and improve customer experience. Solutions like Versapay unify invoicing, payments, and ERP integration in one platform.

The platform for turning cash flow chaos into clarity

Fully unified accounts receivable automation software that helps finance teams simplify the invoice to cash process, from invoicing to reconciliation. Remove friction, accelerate cash flow, and finally take control.

You deserve flow. Not friction.

You lose time, visibility, and control when invoicing, collections, and payments aren't smooth. Versapay cuts through the chaos, so your AR works with you, not against you.

less time managing receivables

faster payments

fewer past-due invoices

Break the (invoice to cash) cycle

Getting paid is not optional

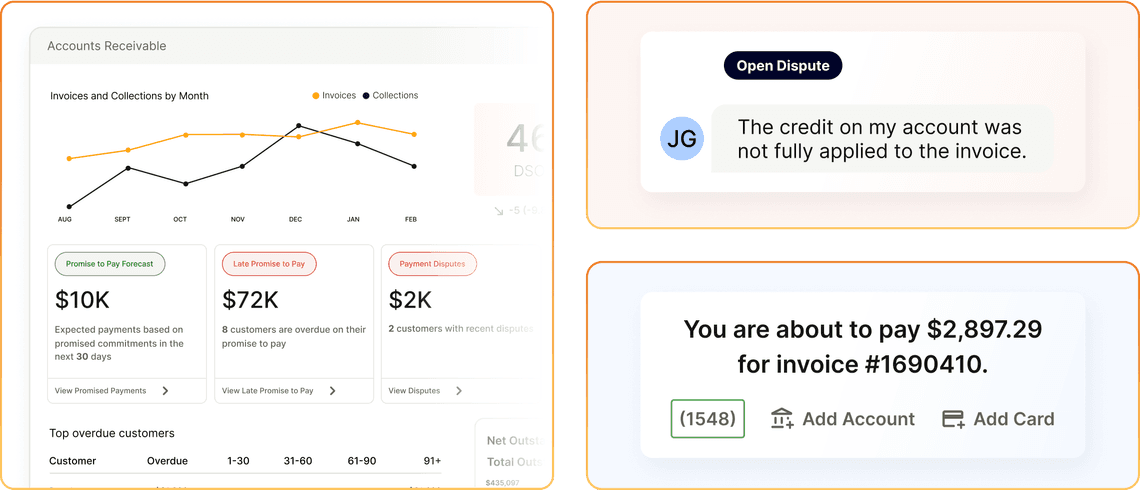

Broken collections, payment delays, manual work, and poor customer experiences make getting paid hard. But high DSO, low visibility, and inefficient accounts receivable processes don’t have to define your AR management. Put an end to:

- Invoices stuck in email threads

- Collections follow up scattered across spreadsheets

- Cash left unapplied for days

- Reports that don't reflect reality

It's the only option

We believe that getting paid should be easy and energizing. Businesses shouldn't be burdened by:

Invisible, unexpected cash flow delays

Disconnected financial operations & systems

Manual tasks that can be automated

LET CASH FLOW FREELY

Take control with an AR automation platform

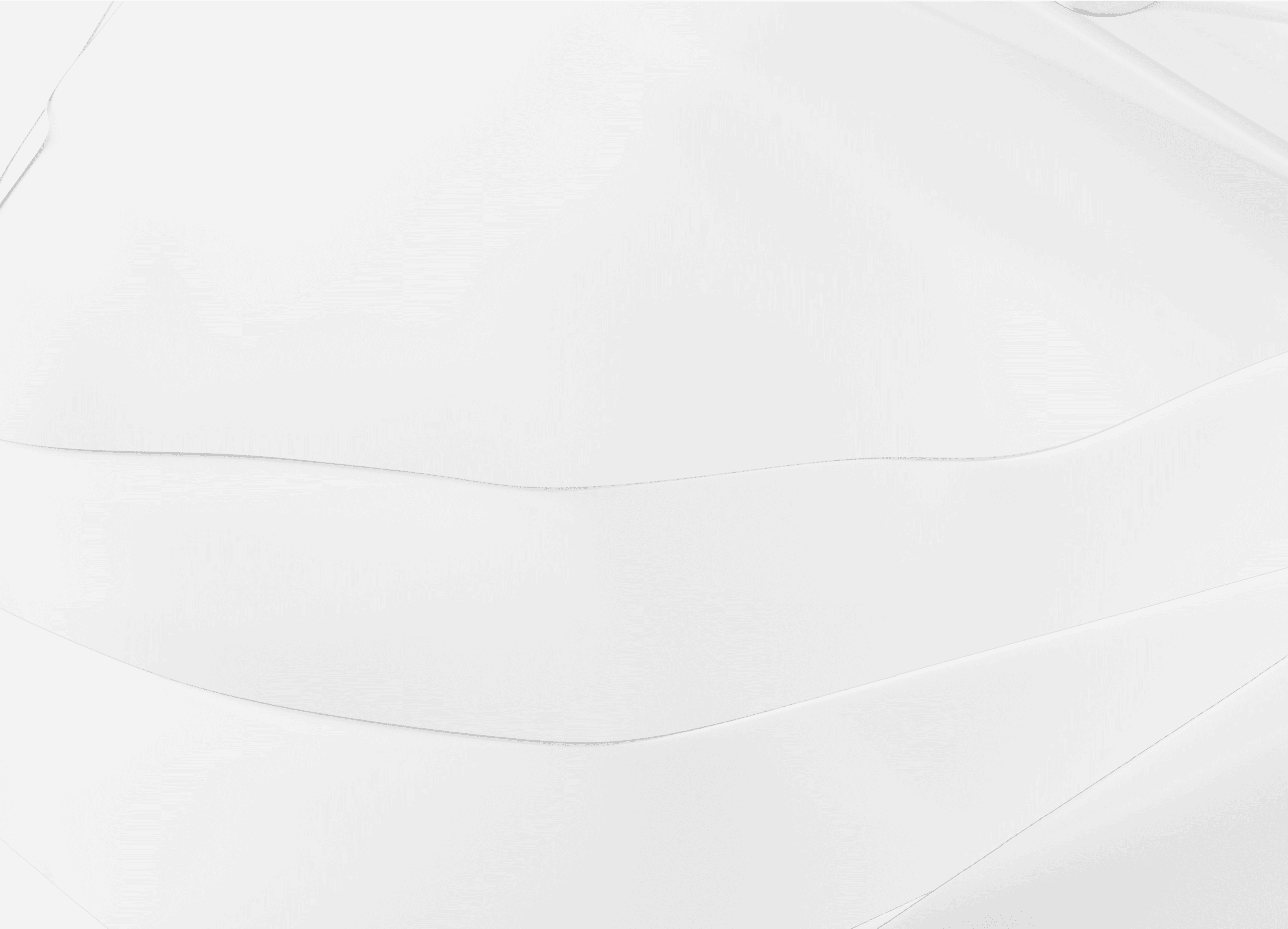

Versapay's AR automation software unifies the entire invoice to cash process, so nothing gets lost, delayed, or misapplied. With built-in automation, AI, collaboration, and ERP integrations, we simplify the complex, returning clarity and control to your team.

- Eliminate delays, inefficiencies, and bottlenecks

- Make confident, quick decisions with predictable cash flow

- Get complete access into payment-related activities

Tour Versapay's AR automation software

Explore solutions

The accounts receivable automation solution for simplifying complex financial operations

Versapay's AR automation platform brings together invoicing, collections, payments, cash application and reporting to simplify the entire accounts receivable process.

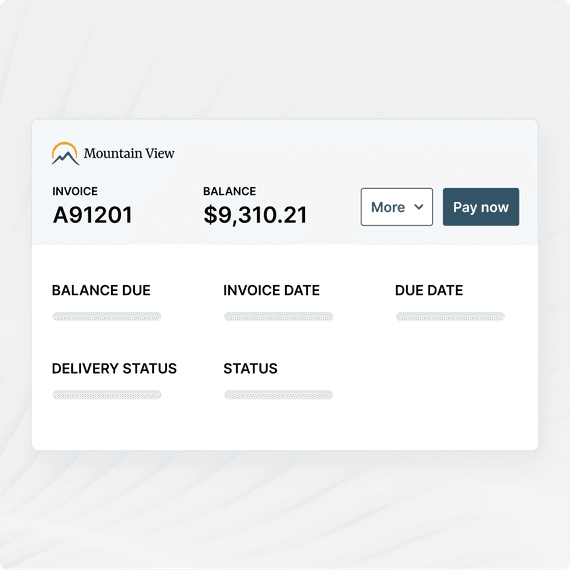

Digital invoicing & customer portal

Automate billing and get your invoices paid faster than ever

Replace outdated billing processes. Versapay’s accounts receivable management system delivers digital invoicing and a customer-friendly payment portal—so it’s easy to pay, view account history, and resolve disputes without back-and-forth.

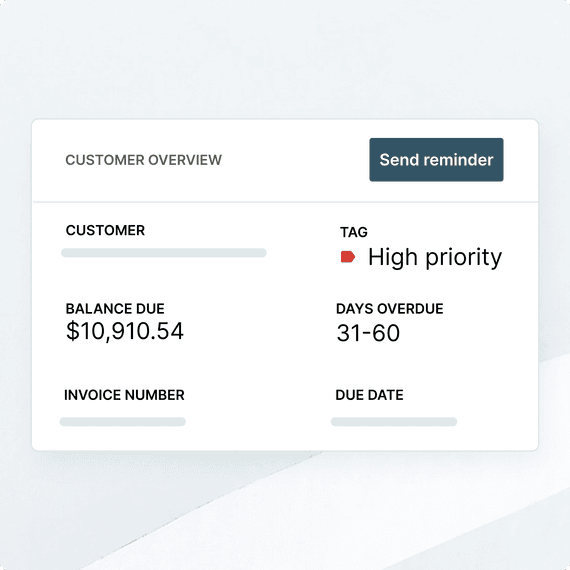

collections management

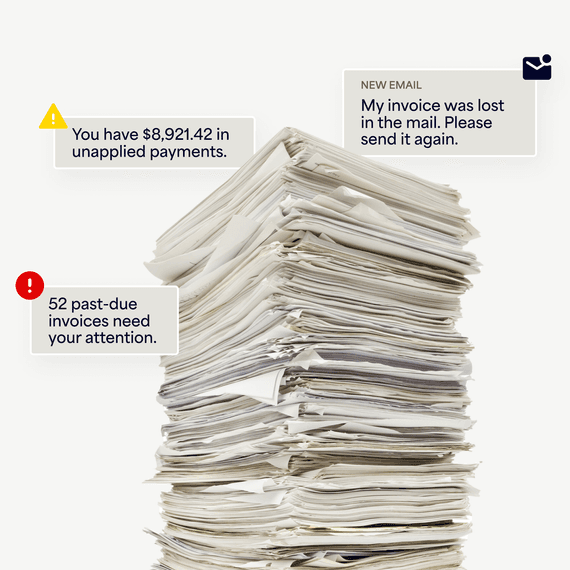

Collect with confidence and stop chasing overdue invoices manually

Stop manually chasing overdue invoices. Versapay’s accounts receivable management system automates outreach, prioritizes by risk, predicts delinquencies, and tracks customer behavior in real time—so collections get done faster.

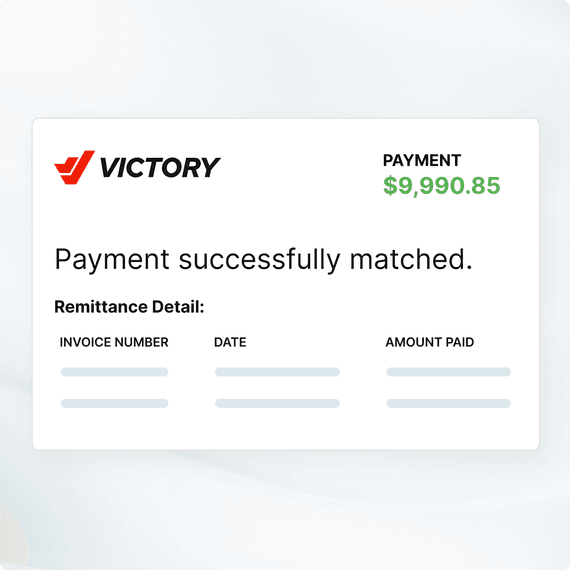

Cash application

Reconcile payments automatically, with zero guesswork

Manual cash application wastes hours and invites errors. Versapay uses AI and machine learning to automatically match payments to invoices—speeding up reconciliation, unlocking cash faster, and freeing your team for more strategic work.

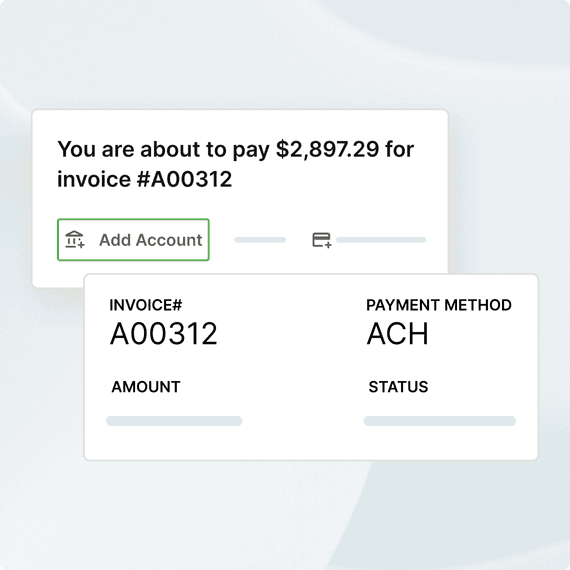

B2B PAYMENT SERVICES

Accept and process digital payments without disruption

Take control of how you get paid by accepting ACH, credit cards, and wire payments in an integrated payments platform. Enjoy faster onboarding, better economics, and total visibility.

Accept and reconcile digital payments without ever leaving your ERP

ERP Payments for Oracle NetSuite

ERP Payments for Sage Intacct

ERP Payments for Dynamics 365

All Open API & Flat File Integrations

Save time and effort, improve cash flow, and fuel growth

Still have questions? We've got answers!

The best accounts receivable software for B2B companies combines automation, collaboration tools, and ERP integration. Versapay is a top choice for midmarket finance teams, offering a fully unified AR automation platform that simplifies collections, accelerates cash flow, and gives customers a modern payment experience. It supports digital invoicing, payment portals, AI-powered cash application, and real-time reporting.

AR automation reduces DSO by accelerating the payment process from invoice delivery to reconciliation. Automated reminders, digital payment options, and real-time tracking of customer activity help ensure on-time payments. Platforms like Versapay also prioritize collections efforts by customer risk and automate cash application, giving finance teams faster access to cash and fewer overdue invoices.

Effective accounts receivable management software should offer: automated invoicing and collections workflows; a self-service customer payment portal; AI-driven cash application; real-time analytics and reporting; seamless ERP integration; customizable rules for risk and dunning. Versapay’s AR platform combines all of these in a single solution to simplify even the most complex AR processes.

Traditional receivables management relies heavily on manual tasks—like emailing invoices, tracking payments in spreadsheets, and applying cash by hand. AR automation, on the other hand, digitizes and streamlines the process. It reduces errors, improves efficiency, and provides real-time visibility into receivables. Tools like Versapay modernize AR by connecting systems, teams, and customers in one platform.